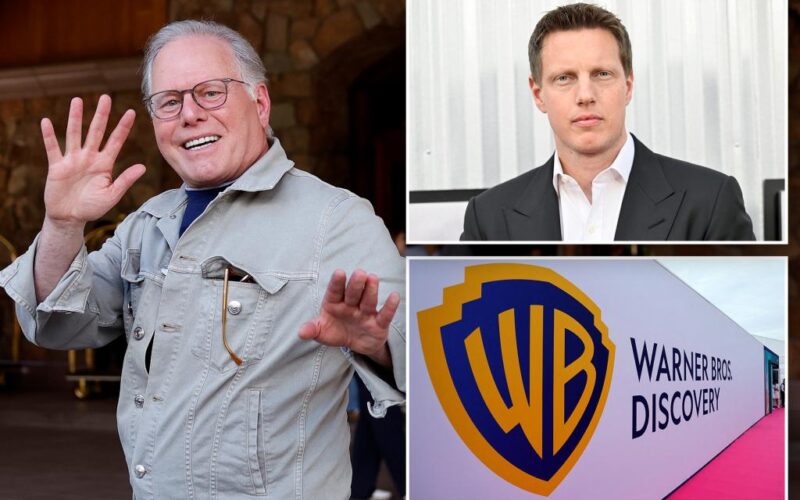

Warner Bros. Discovery chief David Zaslav is looking to set up a bidding war for his media conglomerate – even as David Ellison’s Paramount Skydance plans a multibillion-dollar takeover offer, The Post has learned.

Paramount Skydance has yet to disclose an official bid for Warner Discovery, the owner of the Warner Brothers studios and the HBO Max streaming service, as well as cable networks like Discovery, TNT and CNN.

But Zaslav isn’t in the waiting mood. According to a person with direct knowledge of the matter, he met earlier this week with his bankers at Goldman Sachs to gauge bidding interest from other media and tech outfits – including Amazon, Apple and Netflix.

His goal, The Post has learned, is to propel the stock price possibly to $40 a share. It closed Thursday just above $16 with a market value of $40 billion. If Zaslav can’t get the price he’s seeking, a source said he plans to use the appreciation of his stock price to buy more content.

“Ellison better come up with a really good offer and it better be cash,” said the person, who asked not to be identified but is involved in Zaslav’s deliberations. “It’s (Zaslav’s) feeling that Ellison is trying to get ahead of the bidding war that is coming.”

A Warner Discovery rep didn’t return calls for comment. A Skydance spokeswoman declined to comment.

Warner Discovery shares skyrocketed nearly 30% Thursday after news leaked of Ellison’s pending all-cash bid for the entire company, which Zaslav plans to split into two publicly traded outfits: One that will include its streaming business and the studio, and another that will include his networks.

That spinoff is slated for next April. It’s unclear if Zaslav will shop Warner Discovery in its entirety or spin off its various properties separately.

As The Post reported exclusively on Thursday, media maven Jay Penske, who owns among other properties Variety, Hollywood Reporter, Rolling Stone and a stake in Vox Media, is said to have expressed interest in ratings-challenged CNN.

Zaslav is said to have believed Penske was low-balling him (a rep for Penske and Zaslav had no immediate comment).

Until the recent buyout interest, shares of Warner Bros. Discovery languished as Zaslav focused on cost cutting, paying down $35 billion in debt. But times are changing. Now Zaslav is betting that the regulatory environment will be conducive to mergers and that cash-rich tech giants are hungry for content.

Both Amazon and Apple are expanding by creating their own content via Amazon Prime and the Apple+ streaming service. Netflix is always looking for content to feed into its system. Ellison’s Skydance, which just closed its $8 billion purchase of Paramount, is backed by his father, Oracle co-founder Larry Ellison.

The elder Ellison. a close friend of President Trump, is now vying with Elon Musk for status as the world’s richest man, with a net worth of close to $400 billion on optimism over Oracle’s AI related business.

The Trump Administration, meanwhile, has signaled a lighter regulatory touch in terms of mergers than Biden’s regulators in the Justice Department’s antitrust department and the Federal Communications Commission, who for years throttled nearly every merger proposal coming out of nearly every industry.

During his first term, Trump’s regulators sought to prevent AT&T’s purchase of what was then Time Warner. A federal court sided with AT&T and the deal eventually went through. But it ultimately failed as a business model leading to the 2022 combination of Warner and Zaslav’s Discovery., putting Zaslav in charge.

But with Trump pal Ellison looking to expand through media mergers, Trump’s merger cops will likely greenlight various combinations, bankers on Wall Street believe.