The former junk bond trader who at one time was the richest man in Los Angeles — flaunting a net worth that reached $6.2 billion — saw his fortune dwindle to nothing as he left behind a widow who is fighting foreclosure on one of America’s most storied mansions.

Gary Winnick, the Long Island native and former Drexel Burnham Lambert executive, built his reputation in the 1970s and ’80s working alongside Michael Milken, mastering leveraged finance and dealmaking at the height of Wall Street excess.

In the late 1990s, Winnick, whose fortune exploded thanks to the internet boom, was described as so rich that his housekeeper became a millionaire.

But by the time he died at the age of 76 in 2023, Winnick was more than $150 million in debt.

Global Crossing, the telecommunications empire that he built into a $50 billion colossus, had borrowed heavily to build its network — betting that demand for bandwidth would explode.

Winnick also spent like someone who believed the money would never stop rolling in.

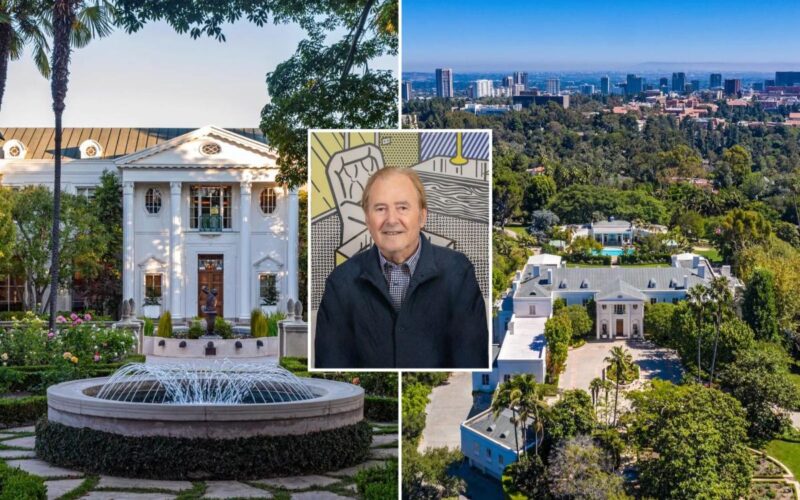

In 2000, Winnick and his wife, Karen, purchased Casa Encantada, the legendary Bel Air estate once owned by Conrad Hilton and David Murdock, for $94 million — the most expensive US home sale ever at the time.

The Winnicks poured tens of millions more into renovations, employing hundreds of artisans and restoring the 40,000-square-foot property to museum-level standards.

The couple kept growing their portfolio of pricey real estate properties — adding a Malibu beach house, a New York pied-à-terre at the Sherry-Netherland Hotel and an art collection featuring works by artists such as Cy Twombly and Edward Hopper.

Winnick also served on the board of the Museum of Modern Art and hosted fundraisers and cultural events at Casa Encantada.

Behind the scenes, however, the foundation of his wealth was already cracking.

In March 2000, the dot-com bubble burst, and internet startups that were among Global Crossing’s clients ran out of cash.

As a result, revenues fell far short of projections, while debt ballooned into the billions, according to the Wall Street Journal.

In January 2002, Global Crossing filed for Chapter 11 bankruptcy, wiping out tens of billions in market value.

Thousands lost their jobs. Pension funds and shareholders sued, accusing Winnick and other executives of misleading investors about the company’s financial health.

Winnick had already cashed out roughly $730 million in stock before the collapse. In 2004, he personally paid $55 million to settle shareholder lawsuits. He was never criminally charged.

While his business fortunes took a turn for the worse, Winnick continued funding his highly ostentatious lifestyle — moving among elite clubs, restaurants and philanthropic circles.

He also invested in a string of ventures across media and technology, including startups that later collapsed or ended in litigation.

Over time, legal battles multiplied — and so did the need for cash.

As Winnick’s legal costs mounted, the loan balance grew. The interest rate remained high. By 2023, the debt had swollen to roughly $155 million.

That year, the Winnicks put Casa Encantada on the market for $250 million, the highest asking price in the country. The sale never closed.

Gary Winnick died suddenly on Nov. 3, 2023, at age 76 — two weeks before he was scheduled to be deposed in a lawsuit tied to a failed investment.

Only after his death, his widow claims, did the full scope of the family’s financial exposure become clear.

Karen Winnick has since said she was unaware that their homes, art and even her wedding ring had been pledged as collateral.

After the family defaulted, CIM — the company which extended Gary Winnick a $100 million revolving loan that was secured by personal assets — moved to foreclose on Casa Encantada and the Malibu property.

The estate that once symbolized Winnick’s ascent became the centerpiece of his downfall.

By late 2025, Casa Encantada was facing foreclosure, its owner’s estate insolvent.

A last-minute court stay temporarily halted an auction that would have sold off the property behind a fountain at a civic plaza east of Los Angeles.