Will an AI bubble turn this bull market into rubble? The growing chorus of doomsayers predicting death and destruction is giving “artificial intelligence” a whole new meaning.

Many believe AI stocks climbed too far, too fast – setting the stage for an imminent 2000-style collapse. But take a closer look: While market sentiment has clearly warmed since 2023, fundamentals significantly underpin AI stocks’ rise – unlike the late 1990s’ internet bubble.

For starters, a little stock market secret: The mere presence of mass bubble blabbering tells you there isn’t one. Real bubbles are eerily rare and almost no one recognizes them until it’s too late.

Yes – AI hype abounds. And yes – the stocks that hype benefits the most have soared. US Tech gained 27% this year, 78% over two years and 160% over three. Firms poured hundreds of billions of dollars into AI in 2025, building data centers and scarfing up chips and servers. About 90% of firms now use AI somehow. Wildly fantastic predictions exist.

It all drives fears of excess – fears of a bubble. Pessimists bemoan exorbitant capital spending and firms’ fumbling to find profitable AI practices. Some claim AI actually will transform everything, but only after a market wipeout whacks overvalued stocks.

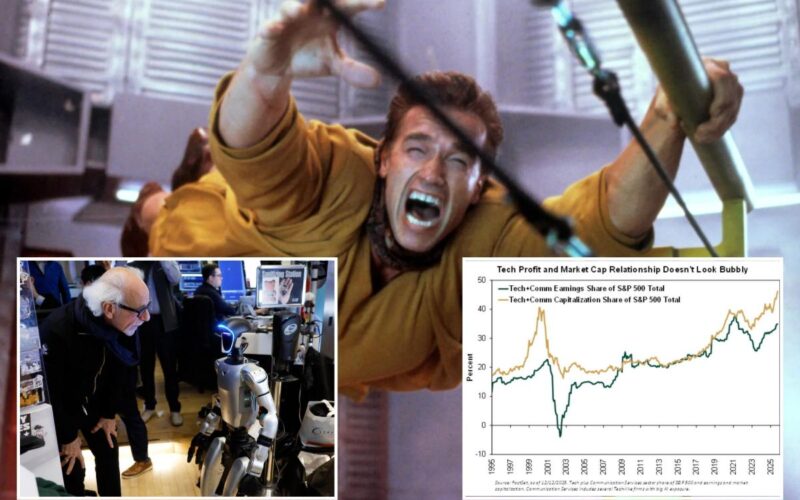

Third-quarter earnings were slightly less boom-bastic than expected. Tech’s recent downside choppiness further frightens – as in, “Is it all starting now?” To hear some tell it, we’re in for a Big Brother dystopian disaster a la the Arnold Schwarzenegger flick “Total Recall.”

Some pessimists fret that various AI firms are issuing more bonds. But scale that for size. Most big players have far more cash on their balance sheets than debt. Others fear circular financing deals (suppliers investing in AI firms, which use that capital to buy the suppliers’ products) displaying an AI ecosphere “house of cards.”

No. That totals less than 4% of the involved firms’ AI spending. Peanuts.

Focus on facts. Most soaring AI stocks are huge firms whose profits have also leapt – very unlike 2000. Fact: They expand mostly via free cash flow, not endlessly burning through rounds of new debt or stock issuance – also unlike 2000. Fact: Big players’ revenues are soaring and AI buildouts aren’t denting their profit margins.

The only valid parallels to 2000 are a) It’s tech and b) Valuations are high with a futuristic story. Back then, all you really needed was a flashy idea ending in “.com” and funding poured in – until it didn’t and bubbly firms and their stocks went “pop” — hundreds of them. Despite mythology, valuations aren’t predictive for stocks (as I documented in November). Tech stocks may rise or fall. But a bubble causes bankruptcies.

I recall 2000 well – I was 50 with 28 years experience doing this. While often labeled a “perma-bull,” the fact is that I am simply “rarely bearish.” That’s because stocks have risen through most of history, about three out of four time periods. Another fact: I was relatively alone predicting the 2000 dot-com bubble, taking my firm to 100% cash – precrash. Look it up online. Back then, anyone predicting that bubble was ridiculed – me included.

Now, the bubble-spooked bears are praised as wise, deep thinkers. That is bullish. Fear is already in stocks.

And timing? You may recall former Federal Reserve Chair Alan Greenspan warning of “irrational exuberance” in his infamous 1996 speech. But the S&P 500 soared another 116% before the 2000 peak. US Tech skyrocketed another 384%.

Embrace the bubble. It is just another brick in this bull market’s wall of worry. And tune in for January’s column with my 2026 forecast. Among other things, I’ll lay out what nobody seems to have yet noticed about 2023 to 2026. (Hint: It doesn’t look like 1997 to 2000.)

Ken Fisher is the founder and executive chairman of Fisher Investments, a four-time New York Times bestselling author, and regular columnist in 21 countries globally.