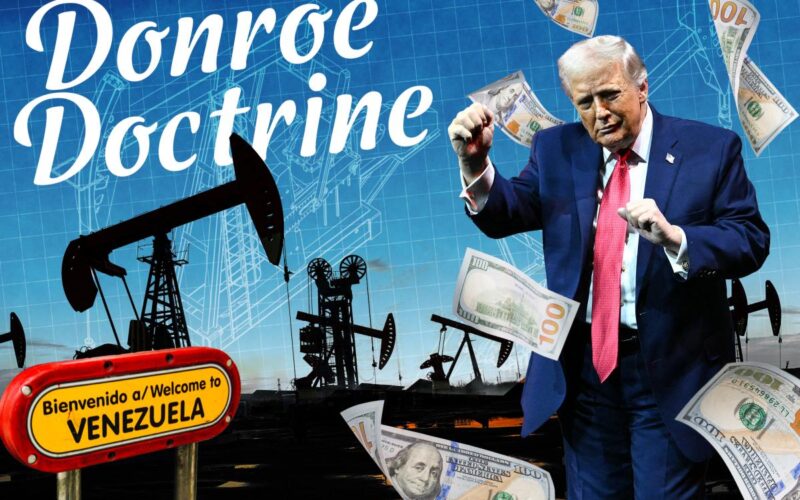

Investors love the “Donroe Doctrine” – and the proof is in the trading of Venezuelan bonds that are among the hottest in the market, On The Money has learned.

President Trump’s arrest of Venezuelan strongman Nicholas Maduro as a narco terrorist has investors snapping up the country’s debt in recent days, accelerated by his stated objectives to rebuild Venezuela’s once-dominant oil industry and provide political stability. It’s also a Trumpian twist on the famous Monroe Doctrine that for years meant exerting US dominance across the Western Hemisphere.

But hundreds of billions of dollars are needed to rebuild the oil and economic infrastructure of Venezuela, destroyed by years of communism, anti-American belligerence and embargoes. For now, at least, investors are betting it will happen — though it might also be wise to hedge your bets if you go there.

The country’s sovereign debt – trading at severely depressed levels – has jumped nicely post Maduro arrest, up from around 32 cents on the dollar to around 42 cents on the dollar at the open of trading Monday when the markets digested the possibility of a communist-free future for the country.

Yes, people made some money over the last couple days, and even more if they saw this early. Kudos to one that I interviewed on “Risk and Return,” the podcast that I host with Bob Sloan, the founder of the data and analytics firm S3 Partners.

In August, Robert Koenigsberger, the founder of Gramercy Funds Management, was already loaded up on Venezuelan debt and the debt of the state-owned oil and gas company, PDVSA, both trading at 12 cents on the dollar, as he prepared for something big to happen that would be a positive.

Koenigsberger had been watching the slow-moving Trump-Maduro situation with great interest for months. That’s because a huge part of being an emerging markets investor – his specialty – is being a value investor and finding stuff that’s being overlooked by just about everyone else.

That stuff involved Venezuelan debt, which defaulted as far back as 2017, a full four years after Maduro took over from his communist mentor, Hugo Chavez. Chavez was the man who launched the country into full-fledged Marxism, “¡Exprópiese!” in the words of the late dictator as he began to confiscate private business and property.

A once vibrant economy was transformed into an economic basket case. It also became a regional enemy selling its vast oil supplies to terrorists and China and shipping drugs to destroy our country. When Maduro took over for the ailing Chavez, who met his maker in 2013, he doubled down on leftism. Sanctions followed that squeezed the economy, and then a default, crashing bond prices.

Joe Biden sought regime change by putting a bounty on Maduro’s head, but fell asleep before it could be accomplished. Once in office, Trump vowed to put an end to his reign. That’s when Koenigsberger began to add to his position that he bought at just pennies (and not many of them) on the dollar.

“Every so often even a blind squirrel finds a nut,” Koenigsberger told us, though he’s playing down his CV; Robert Koenigberger is among the best emerging markets investors out there. “To us it was obvious that something would happen, we just weren’t sure exactly what that would be.”

Koenigsberger says the discussion inside Gramercy was whether there would be a “Cap R” change – meaning the entire government infrastructure is taken out – or would it just be Maduro getting ousted (either through leaving on his own or being taken out) with the party apparatus remaining through a transition period.

What happened is the latter, which should be a cautionary tale for investors. Yes, the run-up in the debt was huge, particularly for Gramercy, but Koenigsberger and his team got in way early. They bet on exuberance over some sort of regime change that would send debt higher, as it did.

The bet now is different: That the current regime of Maduro cronies that have been left in place will give up power peacefully, hold free and fair elections and allow private investment to come back. That includes US oil companies looking to rebuild the petrol infrastructure.

In other words, proceed with caution.