A staggering 60% of California voters back the billionaire wealth tax proposal even though they admit it will spark businesses to flee the state and kill jobs, a new poll found.

Even when presented with a “full battery of economic and political arguments” against the wealth tax, Californians still back it by 54%, according to the poll of likely voters by public affairs firm Nestpoint.

“California voters are signaling something very clearly,” John Thomas, a veteran Republican political strategist who co-founded Nestpoint, told The Post.

“They are far more concerned with cost of living and public services than with the financial well-being of billionaires or the warnings coming from political and economic elites.”

A firm 52% of likely voters admitted that the tax will push entrepreneurs and jobs out of the Golden State, but only 48% agree that there are concerns with long-term revenue from a wealth tax while 42% had concerns about Silicon Valley getting damaged, the poll found.

“California voters are voting with their values, not their calculators — and that’s exactly why this tax is likely to pass. The irony is that while voters don’t care if billionaires leave, capital absolutely will,” Thomas added.

Progressive activists have rapidly been garnering the 875,000 signatures needed by the end of spring to put the 2026 Billionaire Tax Act up for vote on the ballot, which would impose a one-time 5% tax on Californians with net worths over $1.1 billion, as well as a phase-out from $1.1 billion to $1 billion.

Critically, the tax would be retroactive for individuals who lived in California on Jan. 1 of this year. California has an estimated 246 billionaires living in the state, according to Forbes.

The retroactive nature of the proposal has spooked some billionaires, prompting a handful of them to wind down their ties to the state, potentially costing taxpayers revenue already, though it’s not fully clear how much.

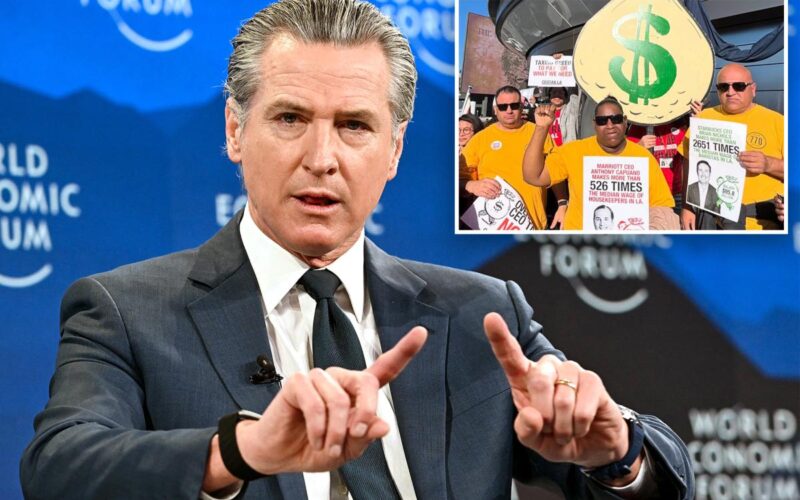

Newsom (D), who is speculated to be contemplating a 2028 presidential run, has challenged his progressive flank and has publicly warned that the tax will backfire.

“The impact of a one-time tax does not solve an ongoing structural challenge,” Newsom said during a Bloomberg News event last week. “You would have a windfall one time and then over the years you would see a significant reduction in taxes because taxpayers will move.”

Lefties such as Sen. Bernie Sanders (I-Vt.) have long championed a wealth tax, arguing that the ultra-rich get most of their wealth from assets such as stocks that aren’t subject to taxation until they’re sold, enabling plutocrats to largely circumvent the income tax that ordinary Americans pay.

A handful of countries have tried different iterations of a wealth tax, though many of them have since either scaled back or repealed them.

Critics argue that an individual’s wealth can fluctuate wildly in a given year, making it difficult to pin down how much gets taxed, that there are complications in selling large amounts of assets that aren’t liquid, and that such a tax will encourage capital flight.

Depending on how large a wealth tax gets, there are also concerns about it evaporating wealth in general.

Sparse polling has shown mixed results on the proposed wealth tax, with one survey commissioned by a GOP strategist and taken by the Mellman Group finding that 48% backing it and 38% against it, with 14% undecided.

The Nestpoint poll shared with The Post has a larger sample size than the Mellman Group survey.

“Voters aren’t bluffing — they’re fine taxing wealth. The people who should be nervous aren’t politicians, they’re the capital allocators quietly booking flights to Texas and Florida,” Thomas stressed, adding that it’s fundamentally an issue of fairness to most California voters.

A campaign of “sustained opposition messaging” could create a “theoretical pathway to defeat” the wealth tax, but that “pathway is narrow and expensive,” a memo from Netpoint concluded. Such a campaign will likely cost tens or hundreds of millions of dollars, per the strategy paper.

The Nestpoint survey sampled 907 likely voters in California from Jan. 2–12 with a margin of error of plus or minus 3 percentage points.