Adidas has sold its last pair of Yeezy sneakers and a turnaround is in sight after ending its partnership with controversial rapper Ye – but now the sneaker giant is bracing for a sales hit from President Trump’s tariffs.

The Germany-based company on Wednesday forecast operating profit between $1.8 billion and $1.9 billion in 2025, below the $2.3 billion expected by analysts.

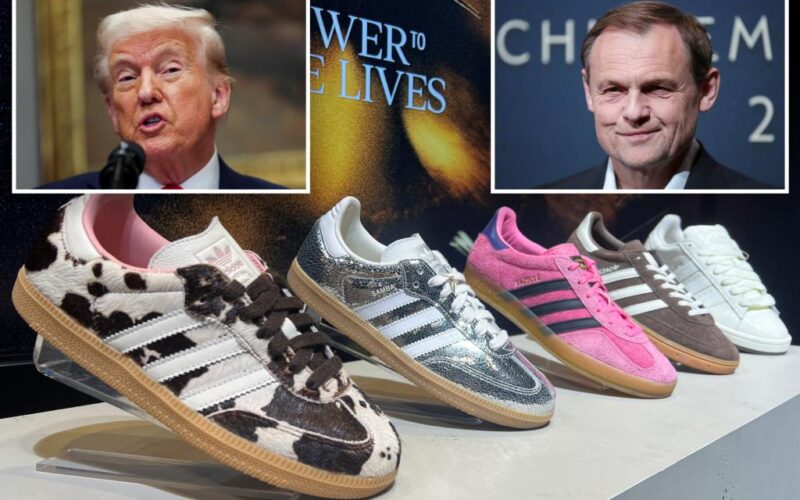

Adidas CEO Bjorn Gulden warned that President Trump’s import tariffs – a 25% levy on goods from Canada and Mexico, and 20% on China – could worsen inflation and force consumers to cut back on spending.

However, he acknowledged that the forecast was conservative and said the company’s goals are higher. Adidas has consistently beat its earnings projections.

“Going into 2025, with all the volatility, we don’t know what’s going to happen with tariffs in the US, we have no idea what that inflation could cause,” Gulden said. “It is of course good to be on the safe side.”

Trump has also threatened to impose tariffs on Vietnam, which is the main manufacturer of Adidas products worldwide.

Since taking the helm in 2023, Gulden has helped Adidas gain market share from struggling rival Nike and recover after Kanye West’s antisemitic outbursts destroyed their Yeezy collaboration.

The athletic brand revealed Wednesday that it has sold its final pair of Yeezy sneakers from its inventory after splitting from Ye in October 2022.

“There is not one Yeezy shoe left, it has all been sold and that episode is behind us,” Harm Ohlmeyer, Adidas’ chief financial officer, said during a press conference.

Losing Yeezy has hurt Adidas’ sales over the past few years, especially in the United States, where Ye’s brand was especially popular.

North America sales dropped 2% in 2024 “solely due to significantly lower Yeezy sales,” Adidas said.

The company started selling off its remaining Yeezy stock in May 2023 with a promise to donate some of the profits to organizations combating antisemitism, like the Anti-Defamation League.

It has set aside around $280 million for donations, or about half of the operating profits it made from selling the Yeezy stock in 2023 and 2024, Adidas said.

The company expects annual revenues to increase at a “high single-digit” rate in 2025, which is lower than last year’s 12% jump.

But excluding the impact from losing Yeezy, Adidas said it would expect growth of more than 10%.

Adidas has been able to gain market share while Nike’s dwindles thanks to the success of its Samba and Gazelle retro sneaker revivals, but it’s looking for new sources of growth.

“The initial boom of the adidas Samba and Gazelle has set the pace, and while these iconic styles maintain a presence in the mass market, they appear to be reaching saturation,” said Lucila Saldana, footwear strategist at trend forecasting firm WGSN.

“Low profile” thinly-soled sneakers and running shoes for everyday wear are some of the new products Adidas is betting on, Gulden said.

The company also confirmed reports from January that it is planning to slash up to 500 jobs at its Germany headquarters in a restructuring effort.

With Post wires