The Atlantic has filed suit against Google — accusing the tech giant of monopolizing the digital advertising market in a legal battle that pits a Silicon Valley colossus against one of the oldest magazines in the country.

The mag alleged that Google and its parent Alphabet have rigged the digital market through secret auction schemes, an antitrust violation known as “tying” and deceptive practices that siphoned millions in revenue from publishers — helping cement the company’s monopoly over the online ad economy.

“These allegations are meritless,” a Google spokesperson told The Post.

“Advertisers and publishers have many choices and when they choose Google’s ad tech tools it’s because they are effective, affordable and easy to use.”

The 94-page complaint was filed in Manhattan federal court. The magazine claims Google used its dominance over ad servers and ad exchanges to force publishers into its ecosystem, suppress competition and drive down the prices paid for online advertising.

At the heart of the case is an allegation of illegal “tying,” an antitrust violation in which a company uses dominance in one must-have product to force customers to take a second product they might not otherwise choose.

The Atlantic claims Google conditioned access to its powerful AdX ad exchange — the marketplace publishers need to reach major advertisers — on mandatory use of Google’s own ad server, DFP, effectively leaving publishers with no practical alternative and shutting rival ad-tech firms out of the market.

The complaint accuses Google of running what it calls a “sophisticated, anticompetitive, and deceptive scheme for well over a decade,” comparing the company’s conduct in digital ad auctions to insider trading on Wall Street.

According to the filing, Google leveraged its control of the publisher ad server to “trade on inside information and [buy] The Atlantic’s inventory on the cheap,” giving its own exchange an unfair edge in billions of auctions.

The lawsuit contends that Google’s could rig bids by seeing rivals’ offers before submitting its own.

The suit also says Google “makes it difficult for publishers to solicit competitive bids from rival exchanges, while at the same time rigging AdX’s bids by trading on inside information from DFP.”

That advantage allowed AdX to win auctions by matching or beating competitors “by as little as a penny,” a practice known internally as “Last Look.”

The Atlantic’s suit also detailed a series of secret internal programs allegedly designed to manipulate auction outcomes without publishers’ knowledge.

One such effort, Project Bernanke, was so sensitive that Google employees were allegedly warned, “The first rule of Bernanke is we don’t talk about Bernanke.”

The complaint claims Google used bid-level data to underpay publishers and build a hidden “slush fund” that could be used to subsidize losing bids and crowd out rival exchanges.

The financial impact, the lawsuit alleges, was severe. In one internal analysis cited in the complaint, Google found that Project Bernanke alone could depress a publisher’s revenue by “upwards of 40%.”

In spite of that, the company allegedly continued to deploy the tool while publicly assuring publishers it was running fair auctions.

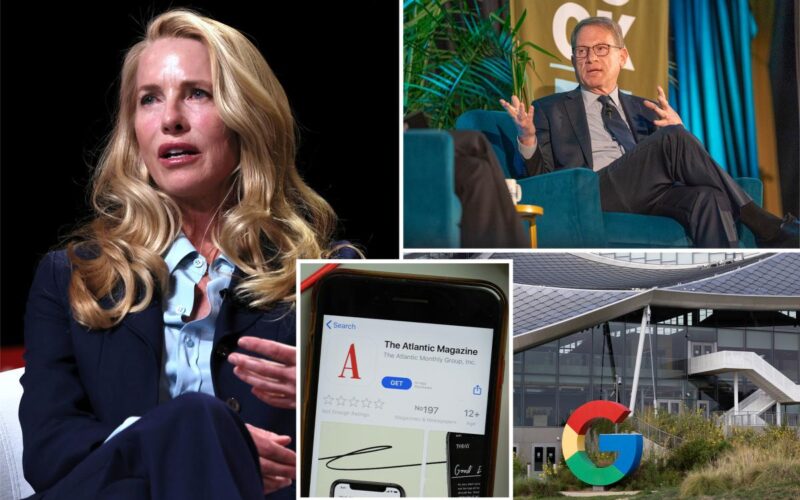

The Atlantic is owned by late Apple co-founder Steve Jobs’ widow Laurene Powell Jobs and traces its founding to 1857, saying modern journalism cannot survive on subscriptions alone.

Instead, Google’s practices have led to “dramatically less revenue for publishers… while Google reaps exorbitant monopoly profits,” including an alleged $30 billion haul in 2022.

The Atlantic’s lawsuit was filed on Tuesday — one day after a nearly identical complaint was submitted by Penske Media Corporation and SheMedia. Both cases are being spearheaded by the same powerhouse law firm, Kellogg, Hansen, Todd, Figel & Frederick.

Penske Media, run by CEO Jay Penske, controls some of the most influential brands in entertainment, music, fashion and culture, including Variety, Rolling Stone, Billboard, The Hollywood Reporter, Women’s Wear Daily, Deadline, IndieWire and Robb Report, as well as Dick Clark Productions.

Like The Atlantic, PMC alleges Google’s dominance over ad servers and exchanges forced its outlets to sell inventory at artificially depressed prices — draining revenue that would otherwise fund journalism, live events and cultural coverage across its vast media empire.

The Post has sought comment from The Atlantic, Google and PMC.