BlackRock and Bank of America dropped their Diversity, Equity, and Inclusion policies — becoming the latest Wall Street giants to scrap the controversial initiative after the White House declared war on woke in corporate America.

Regulatory filings reviewed by The Post show that Larry Fink’s BlackRock, the world’s largest asset manager with $11.4 trillion under management, and the Brian Moynihan-led lender have axed language that promoted the representation and participation of different minority groups.

The moves follow a crackdown led by President Donald Trump on DEI in the workplace, tasking Attorney General Pam Bondi in a Jan. 21 executive order that asked her to stamp out the practice.

Bondi then vowed in a Feb. 5 memo that her DOJ would “investigate, eliminate, and penalize” such policies in the private sector.

BlackRock, in its latest annual report filed late Tuesday, said that the company’s business “requires attracting the best people from across the world.”

“BlackRock is committed to creating an environment that supports top talent and fosters diverse perspectives to avoid groupthink,” the report added.

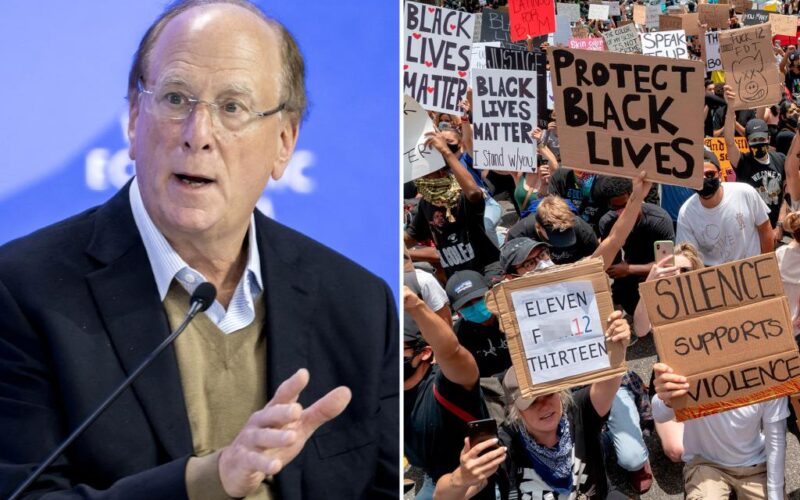

That represents a huge climbdown for the Democrat-donating CEO, who joined the chorus of Wall Street executives backing DEI in the aftermath of the killing of George Floyd in 2020 and the Black Lives Matter movement.

In a letter to shareholders in 2021, Fink claimed: “To truly drive change, we must embed DEI into everything we do.”

The Post has reached out to Blackrock for comment.

BofA also backed off the much-criticized DEI policies in its annual report filed on Tuesday evening, formally ending the requirements for hiring and interviewing bankers.

“We are deliberate about the many ways we seek to create an inclusive environment where everyone has

the opportunity to achieve their career goals,” the Charlotte-based firm wrote.

A rep for Bank of America confirmed that was no longer company policy.

“We evaluate and adjust our programs in light of new laws, court decisions, and, more recently, executive orders from the new administration,” the spokesperson told The Post on Wednesday.

“Our goal has been and continues to be to make opportunities available for all of our clients, shareholders, teammates, and the communities we serve.”

The rollback of DEI by the two giants of American finance echoes what some of their rivals have been doing since Trump trounced Kamala Harris on Nov. 5 in the race for the White House.

Wells Fargo, Citigroup, and Morgan Stanley have also scaled back their DEI commitments, while Goldman Sachs recently canceled a requirement to only take companies public if they had two diverse board members.

JPMorgan CEO Jamie Dimon seemingly remains an outlier, insisting on Monday that nation’s largest bank would stand by its diversity policies, despite lashing out at DEI initiatives in a leaked recording of a town hall meeting with Chase employees.

Dimon told the audience that he “was never a firm believer in bias training” and blasted how the company was “spending money on some of this stupid shit.”

The Wall Street giant also scrubbed much of its DEI language in its recent annual report to investors, further confirming the shift in mood at America’s major banks.

“Everyone in my industry wants diversity in their teams and a workplace that reflects society at large, but everybody on Wall Street privately agrees that the DEI doctrine had started to actually go too far. People have been afraid to speak up,” said Dan McCarthy, a veteran Wall Street headhunter and CEO of the specialist global search firm, One Search.

“My clients are still hiring diversity and they are telling us that they want to continue to hire diversity,” McCarthy, the head of the Young Women Into Finance non-profit, added.

“But some DEI policies became toxic to the point where they became discriminatory. It feels like we are starting to see more common sense around it.”