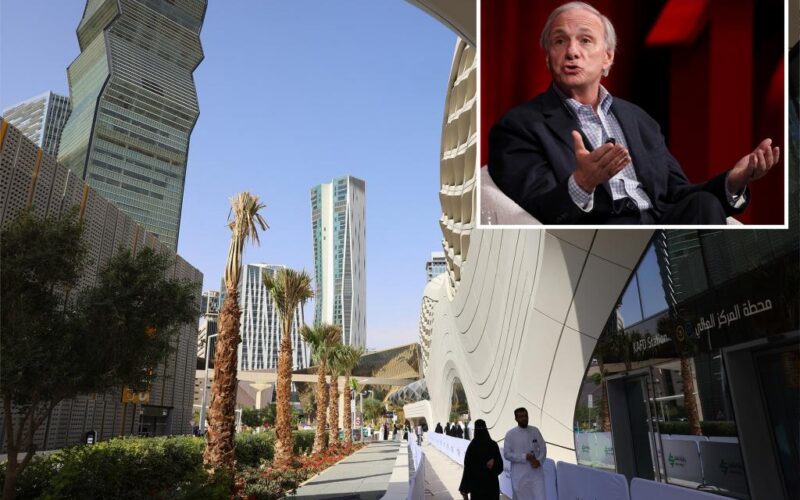

Ray Dalio, the billionaire founder of the world’s largest hedge fund Bridgewater Associates, is set to open a new investing outpost in Saudi Arabia, The Post has learned.

The New York-born hedge fund titan — whose net worth is estimated by Forbes at $14 billion — is opening a so-called “family office” in the Saudi capital of Riyadh to help manage his investment and philanthropic work in the region, sources said.

That’s after President Donald Trump this week inked deals worth $600 billion with the Persian Gulf kingdom at the Saudi-US Investment Forum — a confab attended by Dalio that insiders have dubbed “MAGA in the Desert”.

The plan also follows Dalio’s decision to open a family office in Abu Dhabi two years ago. He already operates two other family offices in New York and Singapore.

A source close to the Bridgewater founder said the move “is under consideration” but that no formal decision had been taken.

Dalio has previously described the Gulf region as an investment hotspot, calling that part of the Middle East “very, very attractive.”

Last year, the 75-year-old lavished praise on Saudi Crown Prince Mohammed Bin Salman, calling him “a great leader” at the young royal’s Future Investment Initiative conference.

He likened the 39-year-old to Singapore’s Lee Kuan Yew, the Asian country’s first-ever prime minister who transformed the former British colony into a financial powerhouse while keeping a strong grip on power.

The Crown Prince, also known as MBS, was accused by the CIA in a report, released in 2021, of ordering the assassination of Washington Post columnist Jamal Khashoggi. Saudi authorities deny any involvement in his killing.

Dalio, who hails from Jackson Heights, Queens, stepped down as Bridgewater’s CEO in 2017 and stepped down as chairman in 2021, but he still sits on its board.

The company he first ran from his two-bedroom apartment in New York City is currently led by Israeli executive Nir Bar Dea, an IDF veteran who joined the firm in 2015.

A report by Fitch, the global ratings agency, published earlier this month said that Saudi Arabia’s asset management industry would “attract steady inflows” over the next two years.

It forecast that assets under management (AUM) in the Gulf Kingdom are “likely to surpass” $350 billion by the end of 2026, up from $266 billion at the end of 2024.

Saudi Arabia’s Vision 2030 initiative aims to attract investment and establish the Gulf state as a global financial hub.

Saudi Arabia’s sovereign wealth fund, known as its Public Investment Fund, manages over $700 billion in assets, drawing increasing interest from global investors.

It led a $400 million takeover of English EPL soccer side Newcastle United in 2021 and launched the LIV golfing series, a rival tournament to the Florida-based PGA, the following year.

Founded by billionaire Dalio about 50 years ago, Connecticut-based Bridgewater counts pension funds, sovereign wealth funds, foundations, and central banks among its investors.

The top firm had $136 billion of assets under management, according to a March filing with the SEC.

Dalio is known for his unorthodox management style, and once reportedly unleashed an email tirade on Bridgewater staffers after he noticed pee on the men’s bathroom floor at its Westport, Conn., headquarters.

The company has undergone a raft of changes since Dalio’s departure from the top job, including the launch of a new fund focused on artificial intelligence and an exchange-traded fund in partnership with State Street Global Advisors.