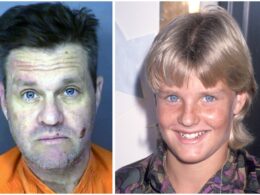

A shocking video of a staged Belt Parkway fender-bender blew the lid off a brazen crash for cash scam allegedly run by two men. The fallout, however, is hitting thousands of innocent drivers right where it hurts: their insurance claims.

The duo’s arrest exposes a dangerous trend plaguing Queens roadways, where organized fraud rings are causing chaos to score bogus insurance payouts.

Now, honest drivers who get into accidents could face a nightmare of suspicion from insurance companies, making it harder than ever to get fair compensation.

A dashcam nightmare: How the scams unfold on Queens streets

Crooks use tactics like swoop and squat, where one car suddenly cuts in front of a victim while another slams on the brakes, causing an unavoidable rear-end collision. Other methods include sudden brake-checks on busy roads or staged side-swipes where drivers claim you merged into their lane.

The Queens District Attorney’s charges allege the Brooklyn-based ring orchestrated these crashes, then funneled their recruits to specific medical clinics to rack up phony injury claims, turning our streets into a criminal enterprise.

The innocent victim’s punishment: Why your claim Is Now Under a Microscope

This widespread fraud has a devastating ripple effect. According to the American Arbitration Association, Queens residents filed 14.7% of all no-fault insurance claims in New York City, putting thousands of legitimate victims in the crosshairs. As of August 2025, Queens saw 10,314 traffic crashes that resulted in injuries, the second-highest tally in the city.

For honest victims, this means aggressive interrogations from adjusters, demands for endless proof, crippling delays and low settlement offers. You’re being punished for crimes you didn’t commit.

An insider’s guide to fighting back

A Queens car accident lawyer from the law firm of Newman, Anzalone & Newman, which has been battling insurance companies for decades, reveals how the game is played against you.

After a major scam hits the news, the insurance playbook gets aggressive, warns the attorney. They start looking for any excuse to deny a claim, and honest drivers get caught in the dragnet. They treat you like a suspect, not a victim. But you can fight back. Here’s how.

Step one: Document everything immediately

At the accident scene, take photos and videos of everything: vehicle damage from multiple angles, skid marks, street signs and the other driver’s license and insurance card.

Get the names and contact information of witnesses. Crucially, always insist on a police report, no matter how minor the crash seems. That report is a powerful official record that can shut down a fraudulent claim before it starts.

Step two: Watch what you say to the adjuster

The other driver’s insurance adjuster will likely call you and seem friendly, but they are not acting in your best interest.

You should never provide a statement before consulting with a lawyer. Even a casual remark, such as saying you feel fine, could later be used to challenge or deny your injury claim once symptoms become more severe.

The adjuster’s primary goal is to get you to say something — anything — that could be used to reduce the value of your claim or shift responsibility onto you.

Step three: Get your own medical evaluation

See a doctor as soon as possible after an accident, even if you feel fine. Adrenaline can mask serious injuries. Go to your own physician or an urgent care center, not a clinic recommended by an insurance company. This creates an independent medical record much harder for an insurer to dispute.

Building an ironclad case: How a Queens car accident lawyer flips the script

When you’re treated like a fraudster, a professional can help you prove your innocence and demand what you’re owed. The Newman, Anzalone & Newman team explains that their approach is to go on offense. They focus on gathering evidence to build a strong case around your claim, making it difficult for an insurer to classify you as having fraudulent claims. An experienced legal team takes steps that a regular person simply can’t.

Uncovering the truth with accident reconstruction

A top Queens car accident lawyer does more than just file paperwork. The firm can bring in accident reconstruction experts who use science to prove what really happened. They analyze vehicle crush damage, debris fields and traffic data to create a definitive report that demonstrates the other driver was at fault and the crash wasn’t staged.

Subpoenaing surveillance and phone records

Your attorney has the legal power to subpoena critical evidence. They can obtain security camera footage from nearby businesses that may have captured the crash. In certain cases, they can even secure phone records proving the at-fault driver was texting or distracted.

Demanding a fair payout for your pain

While insurance companies fight to protect their profits, a dedicated legal team like the one at Newman, Anzalone & Newman fights for you. They ensure you are compensated not just for your medical bills and car repairs, but for your pain, suffering, lost wages and the disruption to your life.

If you’ve been in a car accident in Queens and feel an insurance company is giving you the runaround, you don’t have to take them on alone. The experts at Newman, Anzalone & Newman offer free initial consultations to help you know your options and rights and protect your claim.

For more information or to schedule a free consultation, visit the firm’s page for personal injury in New York.