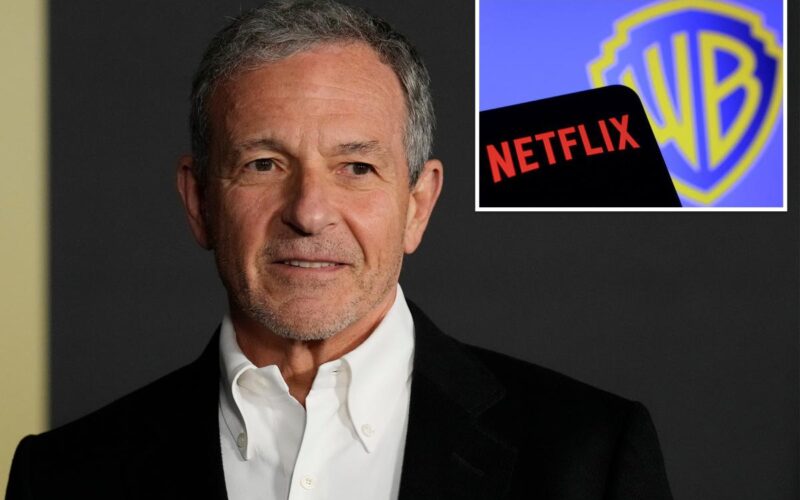

Disney CEO Bob Iger raised red flags about the prospect of Netflix acquiring Warner Bros. Discovery’s streaming and studio assets, warning that the deal could hand the streaming giant unhealthy “pricing leverage over the consumer.”

Telling CNBC’s “Squawk Box” on Thursday that Disney is yet to take an official stance on the proposed mega-merger, he nevertheless raised concerns.

“I think if I were a regulator looking at this combination, I’d look at a few things. First of all, I would look at what the impact is on the consumer,” he said.

“Will one company end up with pricing leverage that might be considered a negative or damaging to the consumer?” Iger continued.

“And with a significant amount of streaming subscriptions across the world, really, does that ultimately give Netflix pricing leverage over the consumer that it might not necessarily be healthy?”

Last week, Netflix and WBD announced Netflix would acquire WBD’s film and streaming businesses — including Warner Bros. studio and HBO — in a mega-deal valuing the assets at roughly $72 billion.

Under the proposed merger, WBD’s linear TV networks would be spun off into a separate publicly traded company, leaving Netflix with the crown jewels of Warner Bros.’ entertainment portfolio.

Just three days later, Paramount Skydance launched a hostile all-cash bid for all of WBD for $30 per share — valuing the company at more than $108 billion and potentially drawing out the bidding war. Paramount is considering raising its takeover offer for Warner Bros. Discovery by as much as 10%,

The Post exclusively reported on Thursday.

Antitrust scrutiny is already looming over the Netflix-WBD agreement, with critics arguing that combining Netflix and HBO Max would give the company an outsized share of global streaming viewing hours.

Iger also pointed to broader implications for Hollywood’s creative economy, particularly theatrical distribution.

“I’d look at what the impact might be on what I’ll call the creative community, but also on the ecosystem of television and films, particularly motion pictures,” he said.

“These movie theaters, which obviously run our films worldwide, operate with relatively thin margins, and they require not only volume, but they require interaction with these films and these movie companies that give them the ability to monetize successfully.”

“That’s a very, very important global business,” Iger added.

The Disney chief drew on his own experience navigating megadeals, referencing Disney’s $72 billion acquisition of most of 21st Century Fox in 2017 — a transaction that left the company heavily leveraged just ahead of the COVID pandemic.

“We’ve got $33 billion in films in the last 20 years … so we’re mindful of protecting the health of that business,” he said. “It’s very important to what I’ll call the media media ecosystem globally.”

Iger stopped short of confirming whether Disney plans to lobby regulators or formally weigh in on the outcome of the Warner Bros. fight.

“We haven’t determined whether we’ll take a position or not … I was suggesting what regulators should be looking at,” he said when asked directly.

Pressed further on whether a Netflix-owned Warner Bros. Discovery would pose a more serious competitive threat to Disney, Iger declined to elaborate.

“No, I’d rather not say anything more than I’ve said,” he replied.

Netflix’s proposal, which has already been approved by the WBD board, hinges on regulatory clearance and the successful separation of the company’s cable networks.

While Paramount’s bid offers shareholders a higher all-cash price and avoids a breakup, it has been rebuffed by WBD leadership to date.

“It’s nice to be an observer and not a participant in this,” Iger said during the interview, which came after Disney announced a $1 billion investment and licensing deal with OpenAI.