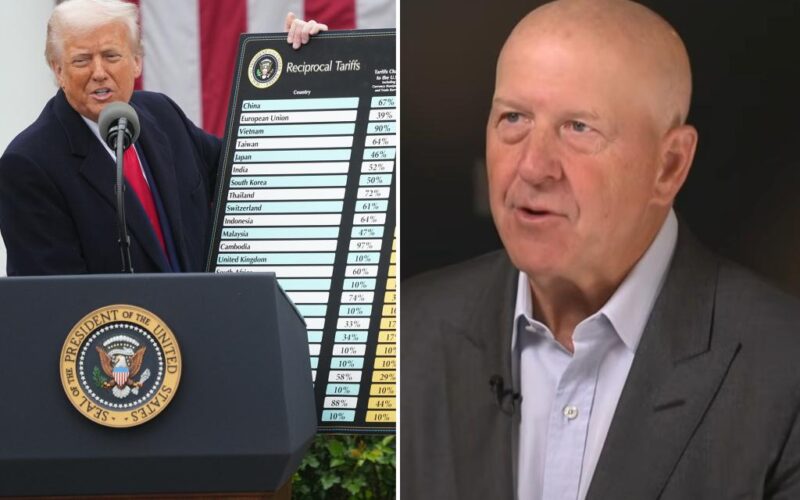

Goldman Sachs CEO David Solomon sounded alarm bells over President Trump’s trade war, warning the looming threat of tariffs is hurting the US economy and forcing CEOs “to tighten their belts.”

The 63-year-old Wall Street titan used a Tuesday interview with Bloomberg TV to issue some of his bluntest public criticism yet of the White House’s tariffs policy as Trump reached the 100-day milestone of his second term.

“The policy actions to date have raised the level of uncertainty to a degree I do not think is healthy for investment and growth,” said Solomon.

“As I am talking to CEOs, talking to our clients, they are holding back on investment, and they are certainly tightening their belts.”

At the same time, Solomon appeared to throw his support behind Trump’s effort to rework the US trading relationship with the EU and cut back on the “regulatory bureaucracy” of “complex” Brussels red tape — particularly when it comes to banking regulations.

“I definitely take away a sense of resolve, of excitement, about actually moving forward, breaking down some of the regulatory barriers that have been inhibitions to growth here, and that would be quite constructive,” the Goldman boss said.

Solomon told Bloomberg that it was “important to get more clarity on the direction” of trade policy so that “things will settle down” in the markets and hand a possible boost to M&A deals.

“Capital markets activity was up year-over-year in the first quarter,” the top banker said. “If the level of uncertainty grows from here, yes, you won’t see the same amount of capital markets activity.”

“People need to transact, need to raise capital, need liquidity for their investments. Part of this is just a reset of expectations,” he added.

His comments come eye-watering $80 million retention bonuses for Solomon and his right-hand man, chief operating officer John Waldron, were formally signed off by shareholders earlier this week.

‘The Big Short’ investor Steve Eisman, who predicted the 2008 global financial crisis, told The Post that he believed dealmaking would be revived once Trump’s trade negotiations had been completed.

“M&A activity will come back and we will get through this, one way or the other,” the lead anchor of the Eisman Playbook podcast said.

“Your model about what a company is going to do is irrelevant right now. There’s only one variable that matters: politics. Everything else is out the window. Take a vacation on your fundamental analysis.”

A report by Goldman economists entitled “Tariff-Induced Recession Risk” cut its US growth forecast for 2025 to 1.3% from 1.5% and predicted a 45% probability of a recession over the next 12 months, up from 35%.

Despite unease about the administration’s trade policies, Wall Street banks reported a surge in trading revenue in the first three months of this year.

Goldman’s trading division reported revenues of $4.2 billion, up 27% from the same period last year, as investors scrambled to remake their portfolios to mitigate the hit from the new tariffs.

An analysis on Trump’s tariffs by New York City’s economic watchdog, the Office of the Comptroller, was published earlier this month and forecast news for Wall Street’s bottom line.

It predicted that 2025 profits will “decline by 20% from their lofty 2024 levels” in a no-recession scenario.

That figure rises to 40% in a mild recession, and as much as 55% in a deep recession, according to the comptroller’s report.

Trump’s announced a string of reciprocal tariffs against some of America’s biggest trading partners on his so-called ‘Liberation Day’ on April 2, only to hit pause on the levies for three months just days later.

Investor fears about trade contributed to a 13% decline in U.S. mergers and acquisitions in the first quarter, according to data compiled by Dealogic, a consultancy, before the Rose Garden announcement.