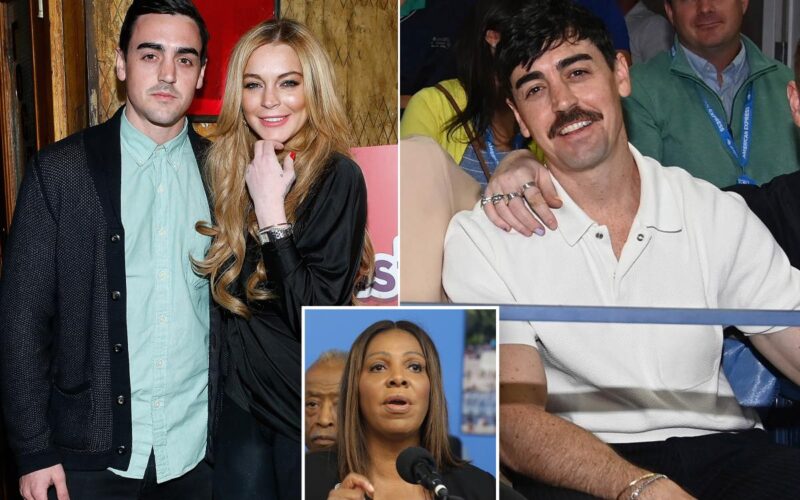

Lindsay Lohan’s younger brother, Michael Lohan Jr., is being sued for allegedly cashing in on the Big Apple real estate market by illegally deregulating more than 150 rent stabilized apartments, state Attorney General Letitia James said.

The Hollywood star’s sibling is among a handful of property honchos from Peak Capital Advisors that were involved in an alleged scheme to oust tenants in rent stabilized apartments in Brooklyn and Queens so they could renovate the buildings into luxury lofts and market them to young professionals for upwards of $6,500 per month in some cases, according to the lawsuit.

The suit, filed last week, alleges that the real estate development company’s bigwigs bought up 31 buildings across the two boroughs dating back to 2019 — including in trendy neighborhoods like Greenpoint and Williamsburg.

They then converted 159 rent-stabilized apartments in those buildings to market-rate so they could overcharge tenants scrambling to live in those areas, court filings allege.

“Peak’s business plan from the outset was to market the apartments to young professionals willing to pay high rents without regard for rent stabilization laws,” the suit states.

“Peak specifically looked for buildings with ‘significant upside potential’ in gentrifying neighborhoods such as Sunnyside, Astoria, Long Island City and Greenpoint.”

As part of the alleged scheme, Lohan and his co-accused exploited an exemption in state housing law that aims to incentivize the rehabilitation of seriously deteriorated buildings.

“Peak ignored the law and renovated solely to increase its profits,” the lawsuit charges.

“Records clearly show that Peak’s buildings did not require extensive renovations to be habitable, as they were in average or good condition when Peak bought them. Therefore, Peak did not meet the legal requirement for deregulation.”

Once the renovations were complete, they allegedly tried to cover their tracks by reassigning apartment numbers in the building to make it harder for tenants and regulators to track whether the rent was actually legal.

Lohan, who is listed as a principal and head of Peak’s investor relations, received rent or was entitled to receive rent from the properties, the lawsuit claims, noting that he “personally received unlawful monetary gains.”

The suit, brought jointly by the AG’s office and the state’s Homes and Community Renewal commission, is asking for the overcharged rent to be paid back, as well as damages for the tenants.

“It is no secret that New York City is already battling an affordable housing crisis, and yet Peak and its operators still chose to line their own pockets at New Yorkers’ expense,” James said in a statement.

“As these bad actors illegally raked in profits, affordable housing in New York grew even more scarce, and that is unacceptable. Let this lawsuit be a warning: when corporate developers and bad landlords try to cheat housing laws, my office will always take aggressive action to stop them.”

The others listed in the lawsuit include: Juan David Gomez, Alex Rabin, Amnay Labou, Bryan Anderson, Alex Kaskel, and Alex Mendik.

The Post reached out to Peak Capital Advisors but didn’t hear back immediately.