The hard-charging trustee of Bernie Madoff’s estate is pushing a New York City power couple to break up their super-sized Manhattan apartment — and sell two-thirds of its square footage to compensate the late Ponzi schemer’s victims, The Post has learned.

Irving Picard — the attorney who has clawed back nearly $15 billion for Madoff customers burned in the fund’s 2008 collapse — is going to unusual lengths to enforce an April 2022 court ruling that found New York lawyer Malcolm Sage was a rare “net winner” in the Madoff mess.

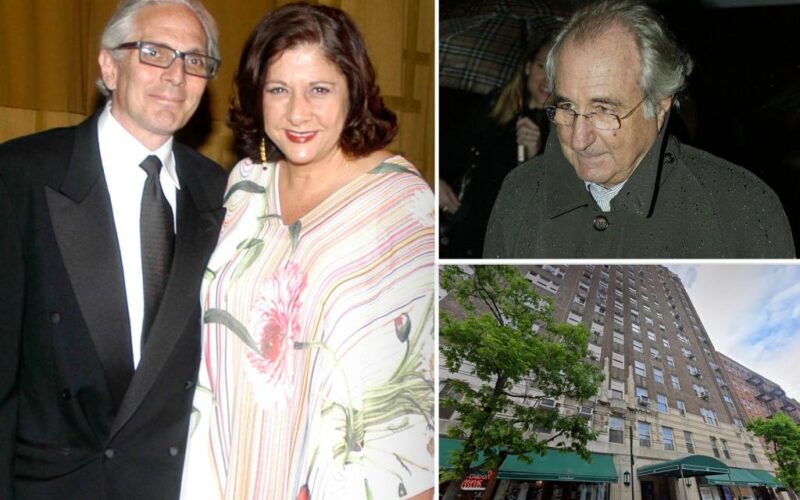

Sage and his wife Lynne Florio — a cosmetics mogul who formerly was a top executive at skincare brand La Prairie — reaped $16.9 million in profits from the ill-fated fund, according to documents filed in New York state Supreme Court.

Picard, however, convinced a federal judge that those who withdrew more than they deposited with Madoff — who died in jail in 2021 while serving 150 years for securities fraud — must give back the difference.

Now, Picard is now pushing for Sage to divvy up the couple’s swanky, 3,000-square-foot Greenwich Village condominium, which they created 30 years ago by joining together three separate units.

Picard claims he can order the seizure of two of the apartments — which measure 1,210 square feet and 902 square feet, respectively — because they “remain legally distinct units and retain their original, distinguishable block and lot numbers.”

He estimates the two apartments are worth an estimated $4.6 million, according to the petition.

“The trustee has never gone to these lengths” to recover assets, said a source familiar with the case.

Walling off and selling those two units would leave Sage and Florio with a 930-square-foot, one-bedroom apartment on the 14th floor at 45 Christopher St. — an Art Deco style tower built in 1931 that claims to be one of the city’s “most-sought after” addresses.

“Malcolm Sage’s only known valuable asset that could be applied towards partial satisfaction of the Judgment is his 50% interest in Apartments 14B/C,” the complaint alleges.

“Selling apartments 14B/C is the only viable means by which (the) petitioner can enforce the judgment,” it adds.

Sage and Florio, who used to run with New York’s glamorous set and were photographed together at the American Ballet Theater gala in May 2007 — a year and a half before the Madoff scandal hit — are now representing themselves without a lawyer, according to court papers.

There is no suggestion that the couple was aware of how Madoff ripped off his investors or any allegations of criminal wrongdoing against them.

In a separate filing on July 7, Sage and Florio claimed they cannot surrender the two properties.

“The suggestion ‘to retreat’ to the confines of a one-bedroom apartment they physically combined with two other units in the 1990s made no sense because the units are not physically able to be divided,” they wrote.

Ariel Berschadsky, an attorney working for Picard, hit back that their story was “ludicrous.”

“Apartment dwellings in New York City are regularly conjoined and separated,” he wrote in a July 8 filing. “In apartments as valuable as those of the Sages, these costs would be inconsequential.”

Sage and Florio insisted that Picard won the judgment against them by “misleading” the judge, calling it “a fraud on the court.”

They wrote to Picard’’s firm, Baker Hostetler, denying that they had profited from Madoff’s dodgy scheme.

“To set the record straight, all Madoff victims were net losers and should have been treated as such,” Sage wrote in his July 16 missive. “These victims should not have to turn over their assets including their homes, through the actions of attorneys capitalizing on the suffering of those already suffering.”

A spokeswoman for Picard’s firm, Baker Hostetler, declined to comment.

Neither Sage nor Florio responded to The Post’s requests for comment.

Sage’s brother, Martin, and sister-in-law, Sybil, settled a similar clawback case on Sept. 5 in which Picard sought to retrieve $4.5 million. The details of the settlement have not been disclosed.

His sister, Ann Passer, was accused by the trustee of raking in $4.7 million. She also agreed to an undisclosed settlement in June last year.

Picard and his law firm were tasked in 2008 with recovering any gains from Madoff’s Ponzi scheme, an investment scam that pays early investors with money from later investors rather than from any actual profits.

He claims on his website that he has raked in nearly $15 billion as of last month from his estimated principal loss of $18 billion.

Set up in 1960, Bernard L Madoff Investment Securities became one of Wall Street’s largest market-makers, a company that matches buyers and sellers of stocks.

Over the years, the firm was investigated eight times by the SEC because it made exceptional returns.

But the 2008 global financial crisis prompted the firm’s demise as Madoff investors, hit by the downturn, tried to withdraw some $7 billion, and he could not find the money to cover it.

The list of those scammed included actor Kevin Bacon, Hall of Fame baseball player Sandy Koufax, the Wilpon family that formerly owned the New York Mets and film director Steven Spielberg’s charitable foundation, Wunderkinder.

A string of banks also lost money, with HSBC Holdings saying it had around $1 billion in exposure and Japan’s Nomura reporting losses of $358 million.