By MELISSA GOLDIN, Associated Press

Don’t splurge just yet.

Rumors spread online Friday that the U.S. government will soon be issuing stimulus checks to taxpayers in certain income brackets.

But Congress has not passed legislation to authorize such payments, and, according to the IRS, no new stimulus checks will be distributed in the coming weeks.

Here’s a closer look at the facts.

CLAIM: The Internal Revenue Service and the Treasury Department have approved $1,390 stimulus checks that will be distributed to low- and middle-income taxpayers by the end of the summer.

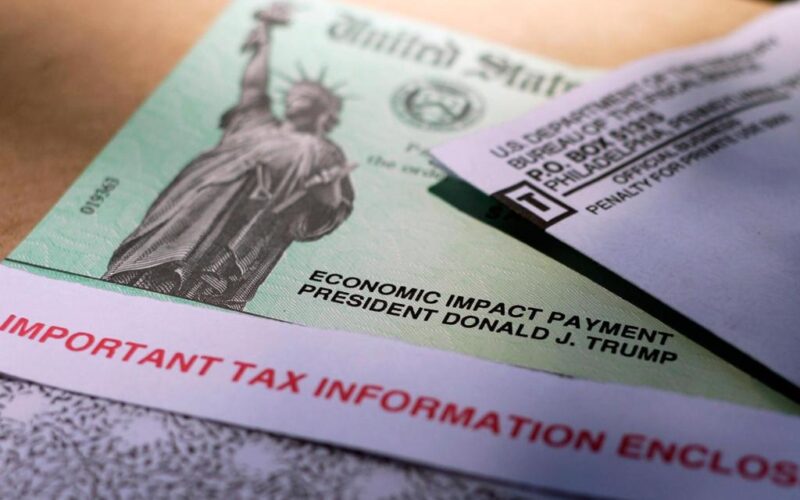

THE FACTS: This is false. Taxpayers will not receive new stimulus checks of any amount this summer, an IRS official said. Stimulus checks, also known as economic impact payments, are authorized by Congress through legislation and distributed by the Treasury Department. Republican Sen. Josh Hawley of Missouri last month introduced a bill that would send tax rebates to qualified taxpayers using revenue from tariffs instituted by President Donald Trump. Hawley’s bill has not passed the Senate or the House.

The IRS announced early this year that it would distribute about $2.4 billion to taxpayers who failed to claim on their 2021 tax returns a Recovery Rebate Credit — a refundable credit for individuals who did not receive one or more COVID-19 stimulus checks. The maximum amount was $1,400 per individual.

Those who hadn’t already filed their 2021 tax return would have needed to file it by April 15 to claim the credit. The IRS official said there is no new credit that taxpayers can claim.

Past stimulus checks have been authorized through legislation passed by Congress. For example, payments during the coronavirus pandemic were made by possible by three bills: the Coronavirus Aid, Relief and Economic Security Act; the COVID-related Tax Relief Act; and the American Rescue Plan Act.

In 2008, stimulus checks were authorized in response to the Great Recession through the Economic Stimulus Act.

The Treasury Department, which includes the Internal Revenue Service, distributed stimulus payments during the COVID-19 pandemic and the Great Recession. The Treasury’s Bureau of the Fiscal Service, formed in 2012, played a role as well during the former crisis.

Hawley in July introduced the American Worker Rebate Act, which would share tariff revenue with qualified Americans through tax rebates. The proposed rebates would amount to at minimum $600 per individual, with additional payments for qualifying children. Rebates could increase if tariff revenue is higher than expected. Taxpayers with an adjusted annual gross income above a certain amount — $75,000 for those filing individually — would receive a reduced rebate.

Hawley said Americans “deserve a tax rebate.”

“Like President Trump proposed, my legislation would allow hard-working Americans to benefit from the wealth that Trump’s tariffs are returning to this country,” Hawley said in a press release.

Neither the Senate nor the House had passed the American Worker Rebate Act as of Friday. It was read twice by the Senate on July 28, the day it was introduced, and referred to the Committee on Finance.

Find AP Fact Checks here: https://apnews.com/APFactCheck.

Originally Published: