A shipping company says it got hit with a surprise $34 million annual tariff bill due to the Trump administration’s recent change in how it classifies freighters.

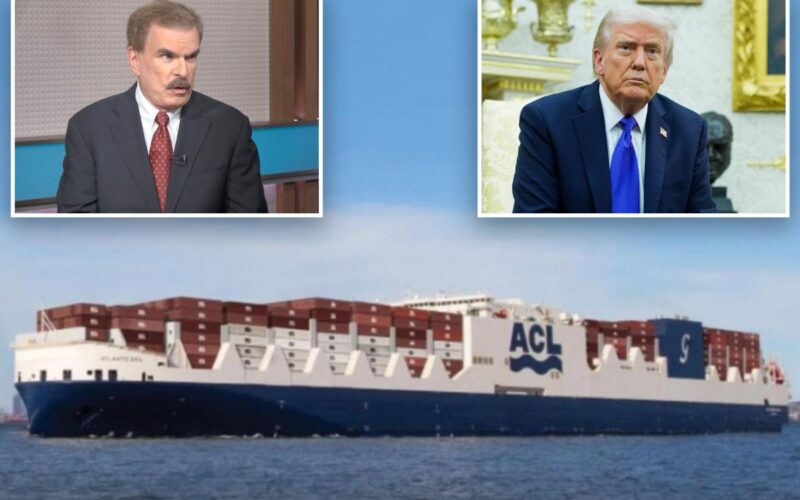

Atlantic Container Line, a major shipping firm that specializes in transatlantic cargo transport, is warning that the steep fees could force it to halt all of its US-linked business.

“There’s a lot of shaking of heads, and what I’ll call just shock,” Andrew Abbott, CEO of ACL, told CNBC.

The US-based company operates five ships on its US-Europe trade route — with each ship sailing regularly between the two destinations multiple times per year.

The US Trade Representative recently updated the rules under Section 301 — a law used to respond to unfair foreign trade practices, often involving China.

The new rule, which went into effect started on Oct. 14, unexpectedly reclassified ACL’s ships.

Under the new USTR rule, every vessel is charged the Section 301 port fee five times per year — that’s once for each US port call the government counts as a taxable event.

“That’s 25 vessels being charged $1.4 million a year,” Abbott told CNBC. “We are looking at a tariff total of $34 million a year.”

ACL runs five ships that carry mostly containers (about 80% of their cargo), but also some big items like tractors, cars, and power plant machinery (around 10%).

Because of how their ships are built — not what they usually carry — the government now considers them “vehicle carriers” — also known as “roll-on/roll-off” vessels (Ro/Ro) — instead of “container ships.”

But Abbot told CNBC that out of the 10% of the company’s Ro/Ro freight, just 1% is passenger cars.

He said that his company’s ships are a “unique hybrid” that combine elements of both container ships and vehicle carriers that “do not exist anywhere else in the world.”

“The vessel should be classified by the majority of freight we move,” Abbott told CNBC.

“That’s containers. We have always been considered a Container vessel. This time around, Customs and Border Protection changed it to Ro/Ro container.”

“Vessels have long been required to report their International Classification of Ships by Type (ICST) code to CBP,” the USTR said in a statement to CNBC.

“USTR’s responsive action utilizes this existing reporting to CBP as a mechanism to determine applicability of service fees under the Section 301 action.”

The USTR added: “To clarify, we note that International Classification of Ships by Type (ICST) is based on the construction characteristics of the marine structure and not upon its particular use or cargo carried at a point in time.”

Abbott responded that container ships that ship from China are exempt from tariffs.

“Big ‘Ro/Ro’ carriers can spread the fees out over their entire ship. We only have 1% of our ship with cars, and yet we are hit with the full costs, and we are the only carrier with an HQ in the USA,” he told CNBC.

“I thought that USTR wanted to encourage people to be in the USA, not push them away. But they are simply showing us the door,” Abbott said.