After Bank America’s first investor day in 14 years, CEO Brian Moynihan is privately declaring victory. For a change, he may have a point.

Yes, we’ve been tough on Moynihan on these pages, pointing out how he has shied away from taking calculated risk – a prerequisite for banking and finance – and leaving BofA shares to languish as an also-ran on Wall Street during his long tenure as CEO.

But based on some numbers I’ve been crunching following his big shindig two weeks ago, Moynihan is right to do some chest pounding – so far only in private – after he pitched the bank’s evolving business model to investors and analysts.

Wall Street sources tell me investors liked what they heard that day from a CEO who until maybe now, has never made the sale about why they should hold stock in the nation’s second-largest bank as opposed to shares of Jamie Dimon’s JPMorgan, the nation’s biggest bank.

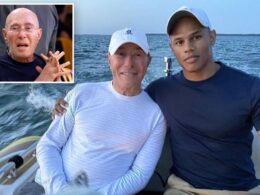

True Dimon is considered the world’s best banker for many reasons including JPM stock price and his own voluble personality. Moynihan, 66, has always been an odd fit in a business dominated by dealmakers and risk takers, like Dimon.

His lawyerly temperament is one of caution. He cut his managerial teeth as general counsel of Fleet Boston, which was among the multitude of acquisitions that led to the creation of the modern BofA. He took over as CEO in 2010 after the financial crisis nearly caused BofA to collapse.

He did a good job pulling BofA off the mat (its shares traded as low as $3), attracting investor cash from the likes of Warren Buffett and scaling back risk. His problem, critics say, is that he never evolved the bank’s business model. It’s the reason why BofA shares have lagged JPMorgan and all of the Big 6 banks.

Investor day was supposed to mark a shift, with Moynihan and a slew of top executives explaining how the bank is now dedicated to producing “responsible growth,” meaning it’s risk-on at BofA – albeit within Moynihanian limits.

As of press time, it seems to have worked. Shares are down since the Nov. 5 presentation, but not as much as the markets (correcting due to tech fears) and, more importantly, Moynihan’s key competitors JPMorgan, Citigroup and Wells Fargo.

Since then, 20 analysts have raised their price targets on BofA shares. I am told that Morgan Stanley lists its stock as its top big bank pick with a price target of $70; it’s currently trading around $50 a share.

We weren’t alone tweaking Moynihan as his stock fell around 2% during the festivities. But after the market closed, something interesting happened: While the CEO was on stage answering questions with the executives slated to take his job when he retires in a few years – CFO Alastair Borthwick, Jim DeMare, head of global markets and Dean Athanasia, head of regional banking – shares began to rise in after-hours trading, largely recovering their losses for the day.

“We appreciate the positive reaction from investors,” a Bofa spokesman tells On The Money. The day gave our leadership team a chance to comprehensively tell the story of our franchise, how we are growing each of our businesses, and the opportunities for growth in the future.”

Of course you can’t erase more than a decade of malaise with just one investor day. If Moynihan’s plan doesn’t lead to better earnings growth, if it fails to meet its all important “return on tangible equity ratio” goal (bank analysts use this number for assessing performance) of 18%, and if it doesn’t improve its stock price, Moynihan’s planned retirement in five years might be expedited.

If the progress of the past two weeks is sustained, who knows? He might stay longer.