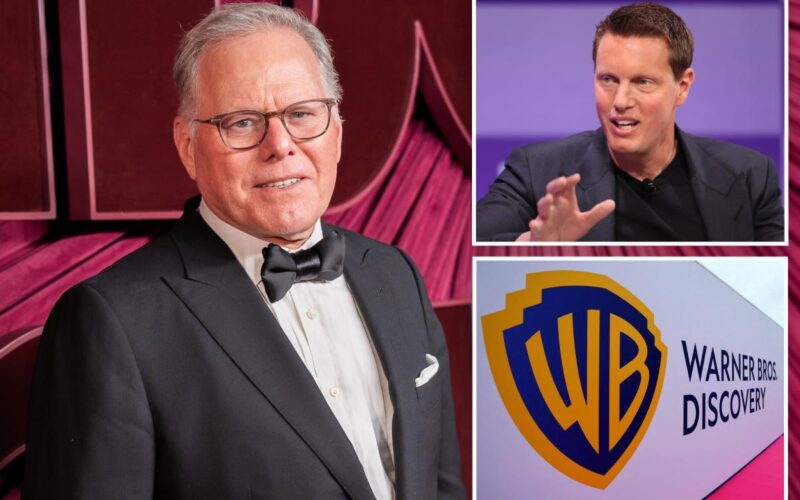

Warner Bros. Discovery CEO David Zaslav stands to pocket a whopping $500 million if the entertainment conglomerate is sold at the price Paramount Skydance has offered, according to a new report.

Zaslav’s payout would come from 21 million shares that immediately vest upon a sale of the entertainment conglomerate, Semafor reported on Thursday, citing details from the CEO’s contract.

The potential windfall adds a striking twist to the ongoing takeover battle that has rocked the country’s media landscape.

Paramount Skydance offered to buy WBD for $23.50 per share — about $56 billion in total — The Post reported earlier this week.

At that valuation, Zaslav would earn a half-billion-dollar payday as his stock holdings and unvested equity awards automatically convert.

While WBD rejected Paramount Skydance’s latest bid, the suitor is readying another offer — and President Trump favors the David Ellison-run entertainment giant among rival bidders, The Post reported.

Zaslav, 65, has long been one of the highest-paid CEOs in media, even as Warner Bros. Discovery’s stock has lagged behind industry peers since the 2022 merger that combined Discovery Inc. and WarnerMedia.

In June, shareholders voted against his $52 million compensation package in a non-binding but highly unusual rebuke of corporate pay practices.

Zaslav has received $470 million in total compensation since 2019, including a $200 million award tied to his contract renewal ahead of the Discovery–Warner merger, Semafor reported.

More than half of those awards remain “out of the money” — meaning the stock must rise substantially before they can be fully cashed in.

Warner Bros. Discovery’s shares had plunged roughly 60% from their 2021 levels before takeover speculation sent them soaring earlier this month.

The company announced Tuesday it has received “unsolicited interest” from multiple parties and was reviewing “strategic alternatives” to maximize shareholder value — language that effectively put the storied studio on the auction block.

Zaslav has reportedly rejected three private offers from Ellison, who is backed by his billionaire father Larry Ellison, as well as private equity firms Apollo Global Management and RedBird Capital.

Sources previously told The Post that Zaslav wants at least $30 a share, or more than $70 billion, for the entire company — a price tag that would value Warner Bros. Discovery well above recent bids.

Zaslav’s defenders argue that the company’s turnaround under his leadership — including record-breaking box-office results and a rebound in streaming subscriptions — justifies the premium.

Warner Bros. became the first studio to surpass $4 billion in global ticket sales this year, while its Max streaming platform has climbed to No. 3 worldwide with roughly 125.7 million subscribers worldwide.

Critics, however, have pointed to the company’s $30 billion debt load and deep cost-cutting measures — including layoffs and the shelving of completed films — as evidence of mismanagement.

The sale process, now led by bankers at JPMorgan and Allen & Co., will give bidders access to Warner’s financials under non-disclosure agreements.

Ellison is expected to return with a fourth offer, sources told The Post, though he has signaled reluctance to go above $25 a share.

People close to him say he is betting that regulatory hurdles and Trump’s hostility toward rival Comcast — owner of left-leaning MSNBC — will narrow the field and improve his odds of landing the deal.

The Post has sought comment from WBD.